Managed Futures

We take on the work for you and make adjustments as needed.

WHY MANAGED FUTURES?

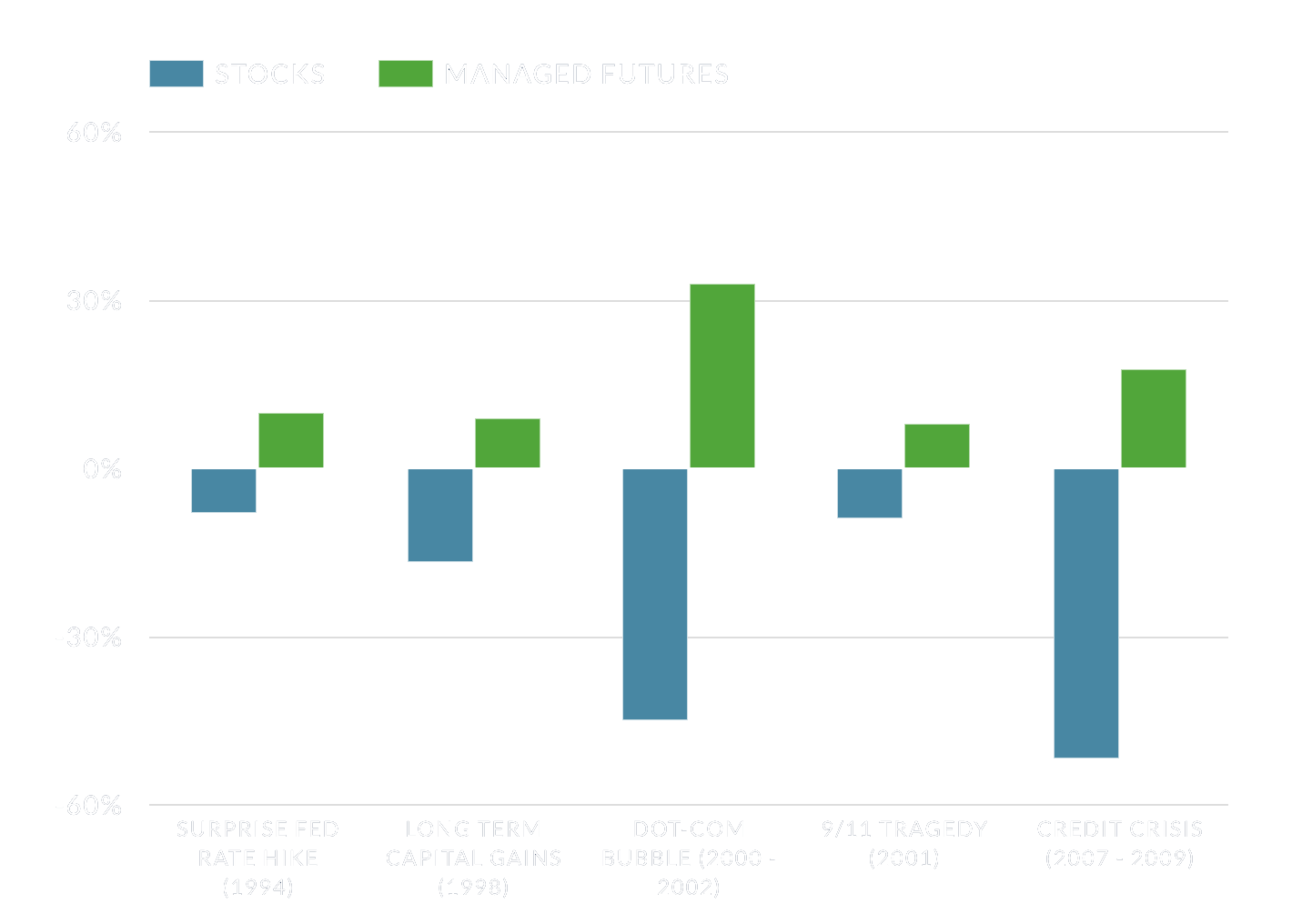

Performance When Stocks Are Down

Futures-based investments are often viewed as higher return/ higher risk, but it is their non correlation with traditional markets which causes managed futures investments to be volatility reducers and portfolio diversifies during the bad times for traditional investments.

CRISIS PERIOD PERFORMANCE

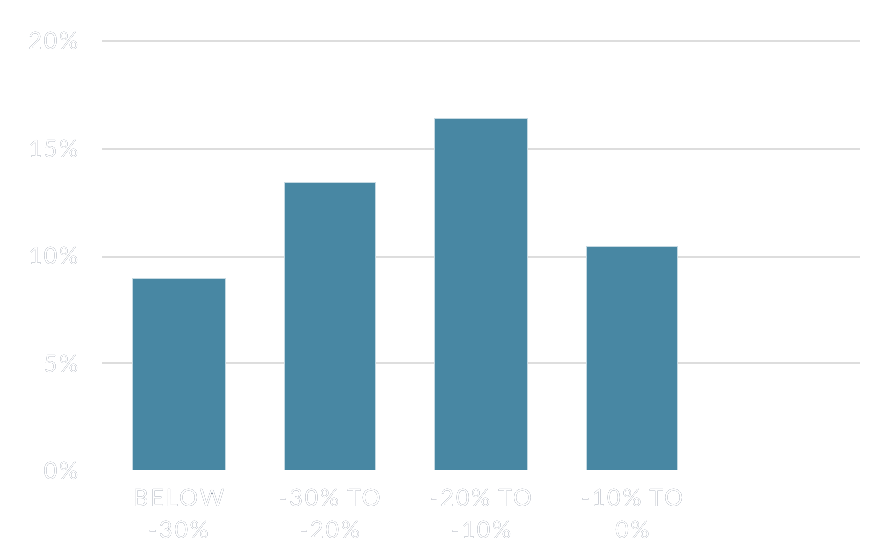

. . .and When Stocks Are Up

Managed Futures non correlation to stock markets means there will be periods when stocks and managed futures both go up in tandem, and periods when they go down in tandem, as well as the periods where they move opposite one another. Taking a longer perspective shows that managed futures can perform in a wide range of stock market environments, including positive performance during stock rallies.

AVERAGE MANAGED FUTURES PERFORMANCE BASED ON STOCKS

FALLING EQUITY MARKETS

RISING EQUITY MARKETS

WHAT ARE MANAGED FUTURES?

Managed Futures are alternative investments which rely on professional investment managers known as Commodity Trading Advisors (CTAs), who specialize in trading exchange traded futures contracts both long and short in markets across the world.

Tactical Commodity Exposure

Managed Futures was one of the only asset classes to capitalize on Crude Oil’s heavy sell off in 2014/2015; and delivers true non correlated performance via accessing different return drivers in markets as diverse as Cotton and Japanese Bonds.